Bank Overdraft is Asset or Liability

These are short-term liabilities. Bank overdraft is considered a liability because it is an excess amount of money that is withdrawn from an account as compared to the amount deposited and that results in a.

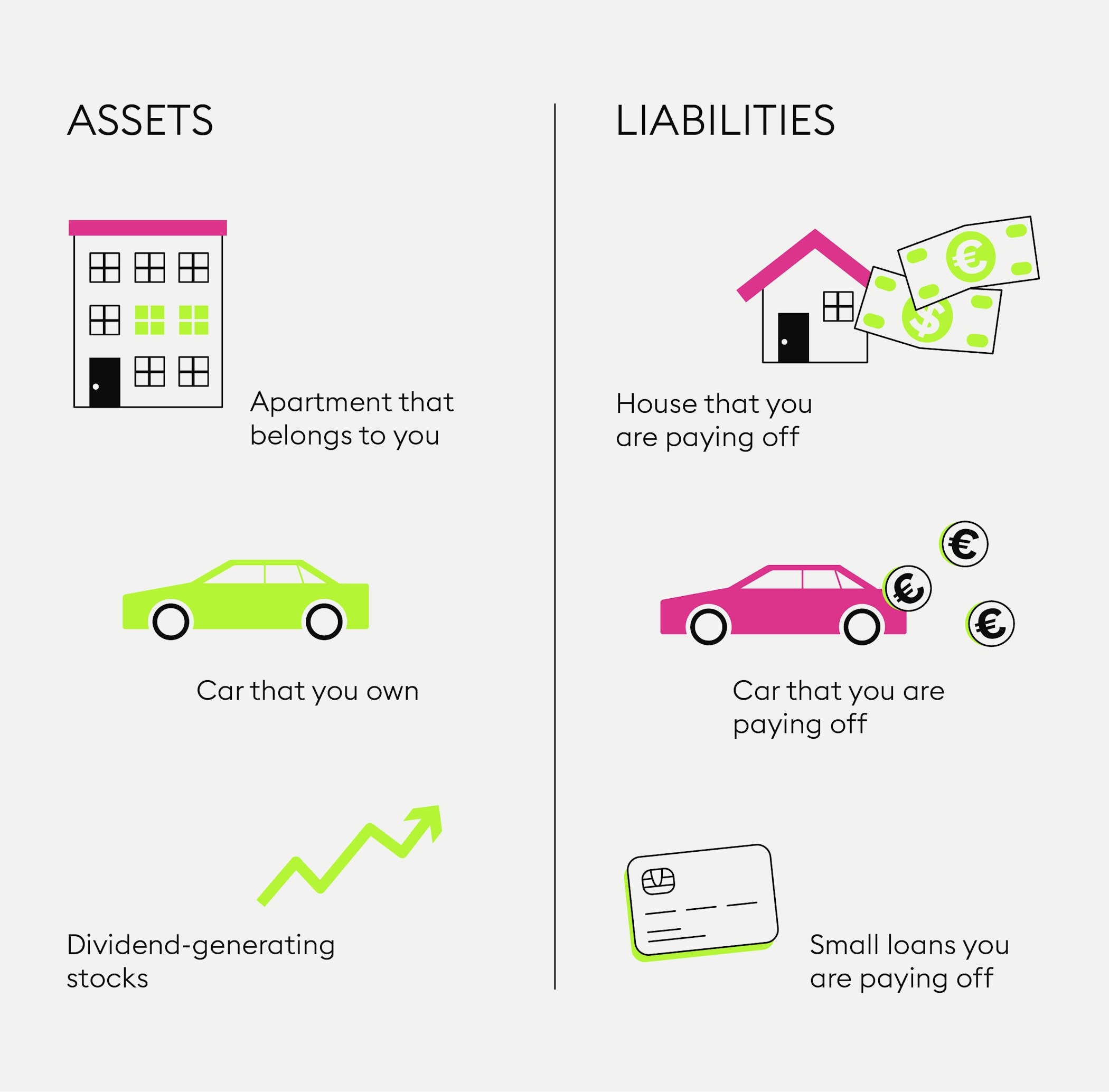

Assets Vs Liabilities Definition Examples Differences Hourly Inc

Because when we over withdrew money from bank it is our.

. However for a bank a deposit is a liability on its balance sheet whereas. An overdraft is an asset for the bank because it is money that they will receive with interest. So it is shown on the liability side in our balance sheet.

Answer 1 of 5. Is bank overdraft a current liability or a long term liability. Yes bank overdraft is considered as a current liability that is payable within the current accounting period.

What Are Current Assets. Accounts payable - This is money owed to suppliers. Overdraft amount with interest to bank.

Assets and Liabilities of Bank. Bank overdraft is a negative bank balance which refers to excess money as compared to the amount deposited. For Commerce 2022 is part of Commerce.

If an asset account has a negative balance it surely represents a liability. For the bank granting the bank overdraft it is an asset. For example trade creditors.

Whether the bank overdraft is an asset or a liability always depends on the perspective. Bank overdraft is a liability for us and is asset for bank. An overdraft is an asset for the bank because it is money that they will receive with interest.

As the term implies this means that the overdraft has not been agreed upon in advance and the account holder has spent more than his. Answer 1 of 9. As per accounting terminology a bank overdraft is shown on the liability side of the balance sheet.

The Questions and Answers of Bankoverdraft is a asset or a liability. Assets and liabilities of a bank - It is an important banking awareness topic for preparation. Answer 1 of 7.

Bank overdraft is aan 1 Liability 2 asset 3 revenue 4 expense 2 See answers. It goes to liability as the payment have to be made in the future. In banking exams the general awareness section will.

Accrued expenses - These are monies due to a third party but not yet. An overdraft is an asset for the bank because it is money that they will receive with interest. What Is a Fixed Asset.

In balance sheet bank overdraft go which side assets or liability. From the customers point of view an. For the company using the.

It is liability for us since we have to repay Bank. Bank Overdraft is a liability for us. I would leave it at as a negative asset unless it is at the end of a reporting period when it should be a.

In any form of business capital is required to run the business smoothly and. If you are talking about a Company Balance Sheet then strictly speaking no since it is in effect a revolving loan no different really to a Credit Card particularly if it has an. Liability to pay it back.

Yes bank overdraft is a liability. Is bank loan an asset or liability. Answer 1 of 3.

Is bank overdraft assets or liabilities. Answer Posted rakesh panchal. Is done on EduRev Study Group by Class 12 Students.

If an overdraft is paid by Associated Bank a deposit must be made to bring the. From the customers point of view an overdraft is a liability because we have to repay. Transaction at issue must be posted to your account before provisional credit may be issued.

Current liabilities are the liabilities which the business has to pay within a year. Current Liabilities for Companies. This discussion on Bankoverdraft is a asset or a liability.

How can you say overdraft is an asset.

Is A Bank Overdraft Liability Quora

What Is A Personal Balance Sheet What Should I Include In My Balance Sheet Ascendant Financial

What Are Assets And Liabilities Bitpanda Academy

Assets Vs Liabilities Business Tax Financial Asset Liability Quotes

No comments for "Bank Overdraft is Asset or Liability"

Post a Comment